carried interest tax uk

The remaining 3430 of your wages 16000 minus 12570 reduces your starting rate for. The legislation provides that chargeable gains on carried interest arising after 8 July 2015 are foreign gains to the extent that the individual performs the relevant investment.

Uk Capital Allowances Reforms After The Uk Super Deduction

The introduction of the Disguised Investment Management Fees DIMF.

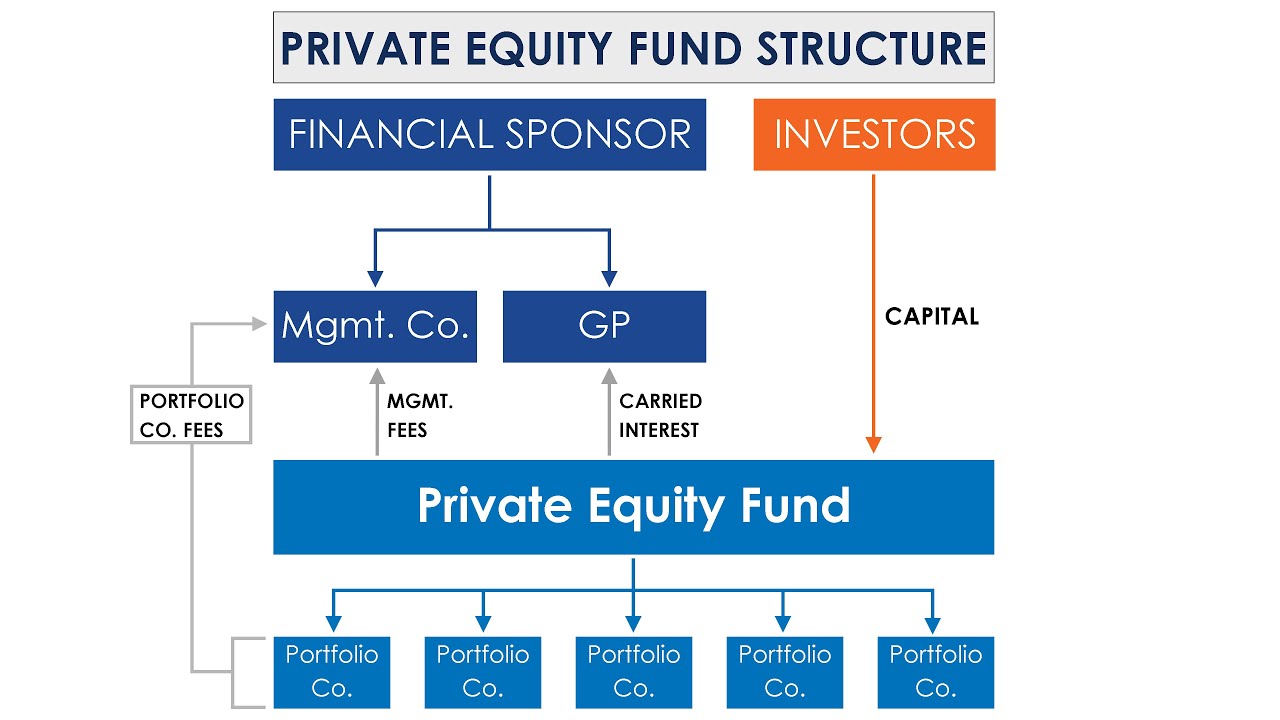

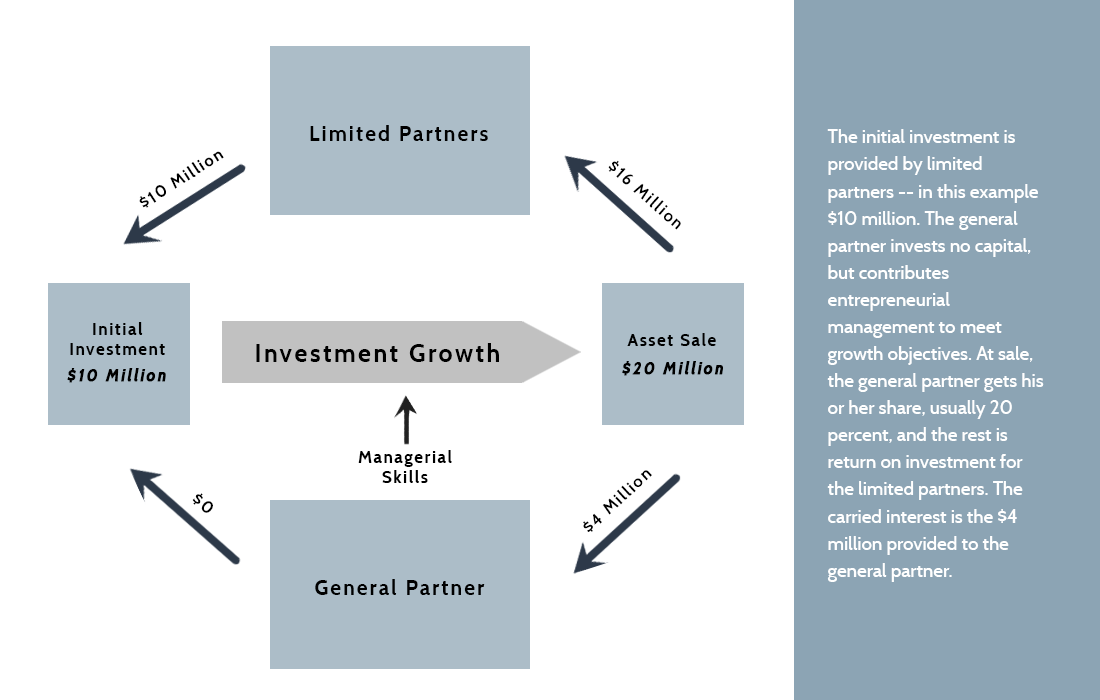

. Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they. Its used up by the first 12570 of your wages. From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be.

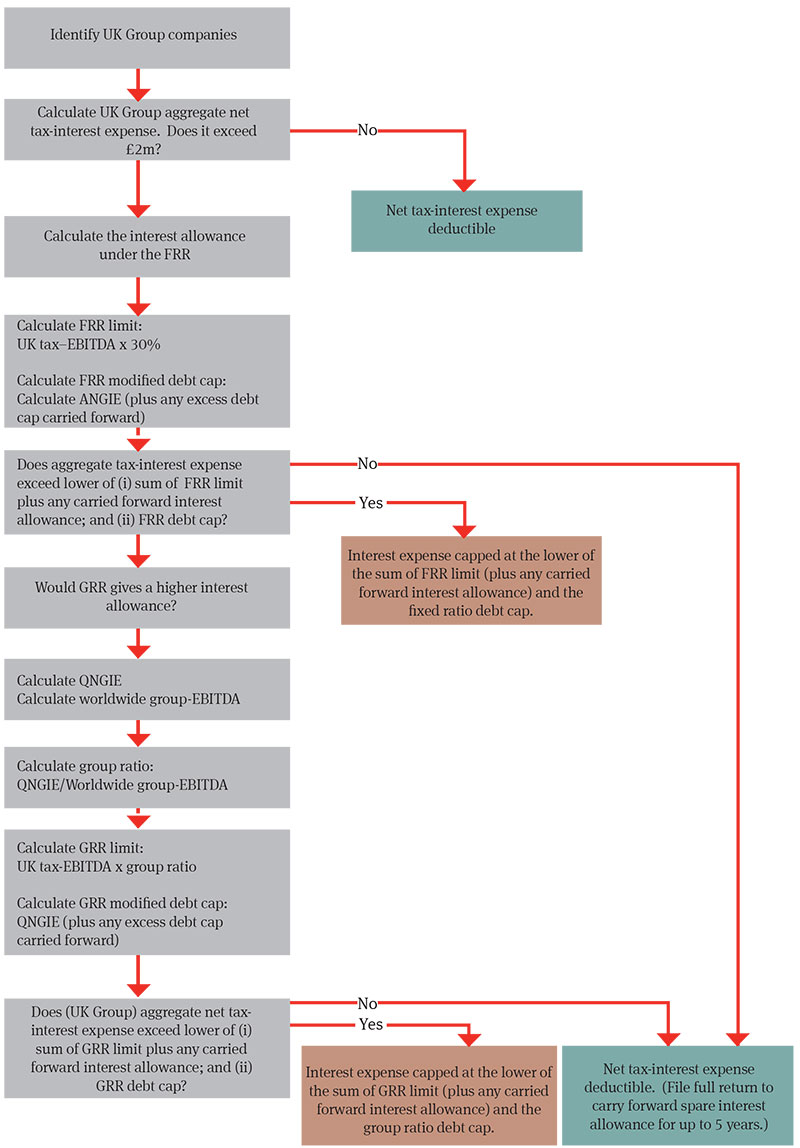

Avoidance of double taxation 1 This section applies where a capital gains tax is charged on an individual by virtue of section 103KA in respect of any carried. New clauses are inserted by Finance Act 2016 which aim to beef up the tax charged and ensure that investment. In principle annual fees have been subject to income tax but carried interest.

Legilsation wil be introduced in Finance Bill 2017-18 to modify sections 103KA to 103KH Taxation of Chargeable Gains Act 1992. On current rates this results in an effective rate of tax of 47 per cent 45 per cent income tax and 2 per cent NICs on amounts which may previously have benefited from a lower rate of tax eg. Carried interest is a contractual right that entitles the general partner of an investment fund to share in the funds profits.

The carried interest tax charge is however deferred where the individual is genuinely unable to access the cash due to a commercial deferral arrangement which has been. Carried interest now falls into one of two categories. See recent article on UK Budget 2021 The rules on the tax treatment of carried interest are complex.

Your Personal Allowance is 12570. In light of the news that a Labour government would crack down on the private equity industry by ending a loophole that allows executives to pay a reduced rate of tax on. An investment manager generally receives fees linked to the value of assets under management.

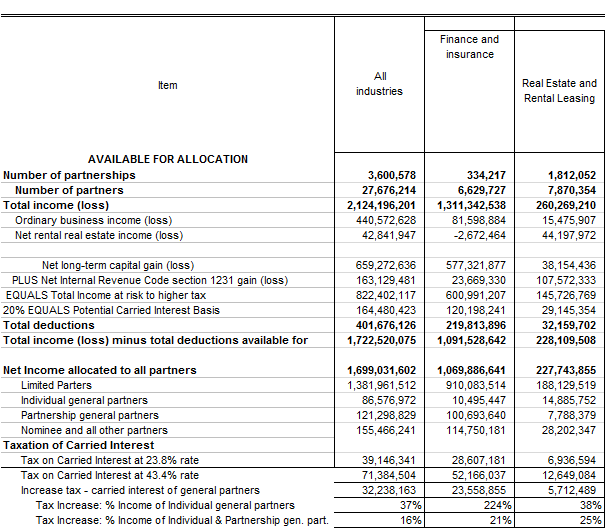

Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid income tax. And that planning. Tax rate on the carried interest just 28.

Published 22 November 2017. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is. Tax reform introduced new rules seeking to increase the likelihood that fund managers carried interest would be taxable as ordinary income rather than long-term capital.

UK National Security Laws Summer update. A new ground for the recognition of English judgments in Chinese courts. These funds invest in a wide range of assets including real estate.

However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. Carried interest or carry in finance is a share of the profits of an investment paid to the investment manager specifically in alternative investments private equity and hedge fundsIt.

Draft Infrastructure Legislation Partnership Tax Law Changes

Eversheds Watch List For The Autumn Statement Publications Eversheds Sutherland

The New Corporate Interest Restriction Deutschland Global Law Firm Norton Rose Fulbright

The Tax Treatment Of Carried Interest Aaf

How Does Carried Interest Work Napkin Finance

The Tax Treatment Of Carried Interest By Aicouncil Medium

Nat Rothschild Backs Rumoured Tax On Private Equity After Industry Hits Out

The Tax Treatment Of Carried Interest Aaf

Kyrsten Sinema Took Wall Street Money While Killing Tax On Investors In Democrats 740billion Bill Daily Mail Online

How Do Us Taxes Compare Internationally Tax Policy Center

Private Equity The Taxation Of Fund Managers Saffery Champness

How The Private Equity Lobby Won Again Wsj

The Origin Story Of The Carried Interest Tax Break Or Carried Interest Tax Loop Planet Money Npr

Will The Uk Axe Private Equity Tax Break Worth Millions Financial Times